Understanding the trading patterns of trade customers is key to unlocking growth opportunities.

Here’s the why and how this would work for the Green and Gold

TP is well placed to grow Market Share

TP can start to look forward with renewed confidence. One area that the brand can now really capitalise on is the digitisation of business. The Merchant area and in particular the General Merchant has many opportunities to be able to grow sales and profits through further digitisation. Getting actionable data into the hands of front line colleagues is where the battle lines are being drawn.

It’s time to get behind the hype and have a look at 4 key things TP can do that will make a significant difference to their overall profitability:

- Understand customer share and opportunity

- Understand promotions and recommendations

- Understand availability, ROCE & net return

- Understand content and messaging

TP is able to Act Nationally, but think Locally. For each customer it’s vital that their relationship is valued by the brand. Everyday, your business is making decisions on where to put resource and which customers to invest in. This is based on our understanding of human behaviour and experience. From Customer Service colleagues to the field, from branches to online merchandising, decisions are being made on how best to serve the customer. Sometimes we focus on our advantage and sometimes with a judgement call to service customer needs based on our relationship and future revenue.

The calculation that goes into this is based on historic knowledge, type of customer, kind of jobs they do, frequency that we see them, how they manage their credit and their brand affinity for the supplies that they need.

All of these factors allow us to respond as humans.

We also know that because there is a local specialist supplier we may not be as competitive at a local level. Some local market requirements are powerful and are difficult to challenge for national brands.

The customers we have the largest Share Of Wallet (SOW) with are the ones whom we know what the addressable categories are that we sell for them. For Local Builders and specialist trades (roofers, landscapers, joiners etc) the challenges are around local supply of knowledge as much as product. Being able to identify the kind of job or project quickly helps to build trust and that comes through to intelligent product recommendations.

By understanding what products are bought with what, that are part of a project, what’s going to be called off and what’s needed next, TP can better intervene with scalable marketing and sales interventions.

Too many tickets are single items. Too many opportunities for selling associated products are missed. Bricks need cement, but more commonly cement is bought with aggregates. There is no point trying to promote landscaping to a roofer.

There is clear correlation between categories bought and trading frequency. By increasing the frequency of purchase, with the right products we can influence the profitability of every customer.

Making the data human

Local Builder’s in urban and suburban environments can also be your most profitable customers if you focus on getting price and availability correct on core lines that they need over and over again. The answer to what price and availability that needs to be will be in the data.

Being able to run these data points and come up with a series of categories and offers takes a lot of firepower. But this is exactly what we can now do. This enables us to have a clear Opportunity in £ value and basket numbers to be useful.

Coupling this with linear regression on predictability allows to put a value and category next to future visits. Where the two meet tells us where we need to activate our intervention, whether that is digitally or human or a combo. Indeed, communication preferences will be in your customer data and not necessarily in your ‘preferences’ silo.

You’re not number one for everyone, yet

What we do know, for the majority of our customers, we are not their number one choice. Most tradespeople will know where the local merchants and wholesalers are, and will have several trade accounts around a locality for convenience and also to spread credit and keep merchants on their toes. I’d argue this is where we can grow more profit, by getting on our toes a bit more.

We do know that per branch, we probably service 15-25% of our base really well. The others we probably don’t know enough about or have found it difficult to engage with.

Give them a conversation

There is no point in giving category offers to the wrong type of trade or a Deal of the Week in a category that they don’t always need. You are better off getting your best suppliers and saying, “Listen I’ve got thousands of builders and contractors who use your stuff. I know that 20% don’t buy as often as they should and 50% buy less than I think we could go at. Support me more accurately with more targeted support and I can win more business.”

By using the data and adjusting the amount of support at a customer level you are not giving up margin and you are growing sales.

This can be applied across branch, digital, CRM campaigns, sales team and call centre.

By being able to advise branch managers, ecomm merchandisers and CRM managers as to the best offer for the right customer on a daily basis, this can change their world in terms of their customer conversations. It’s no longer about ‘have you got a job coming up that I can quote on’ it’s ‘I’ve managed to change some prices for you on these key categories and we’ve got better availability now on those skus you like’.

You’re doing them a favour, not the other way round.

We can also start to have the conversation with suppliers as to how they can help.

The Role of The Supplier

You also won’t waste supplier goodwill. Typically suppliers aren’t that bothered where customers buy the product, but they will care that their support £ are going to customers who need them to not use a competitor product. They should primarily work with you on making sure the category offer is right. And that’s exactly where these techniques are so successful.

In turn, for you, you can start to target rebate volumes, giving you a net net return. More sales, more profits. Once you get the category purchase you can then think about the own-brand switch.

Scripting, content and messaging

We’re traders, so we don’t want a load of automotons. But we do want to give sales guidance for everyone who needs it. Staff are difficult to train, experience is hard to get, some of our best customer facing staff get promoted to non-customer facing positions as we try and share the best practice.

But what if that best practise could be systemised into the daily hubbub?

Often, we are masters of the New Initiative, rather than a Continuous Improvement Pathway that takes into account how we exceed on customer service.

In merchanting and trade supplies, this is a 5 part process:

1. Identifying the customer & Proactively seeing what they need

2. Consistent pricing, help & knowledge, timely proactive activity

3. Smooth and consistent availability

4. Manageable and accurate admin

5. Follow up and proactive next action

All of these touchpoints and service operations can be automated and administered systematically to ensure that we continuously improve. If you mess up a customer order, even once, that can lead to a massive reduction in the lifetime value of that customer. Using OTIF is fine, but it can be a slightly loose definition and it often isn’t reported at a customer level within the context of lifetime value or opportunity to grow.

Six Month Action Plan

The difference is, this is action based, predictive analytics. It’s not waiting for customers to downtrade, it’s not reactive.

We’d suggest a 6 Month Plan for Sales Focus in 2021:

- Opportunity, Predictability, Interventions

- Data Strategy

- Content, offer and messaging

- Supplier/Cat Man/Net Return Analysis

- Systemisation for growth

- Ongoing refinement for profitability

You’d probably be curious as to what it actually is, how does this concept come to life? Well, its data and it’s a way of easily accessing that data.

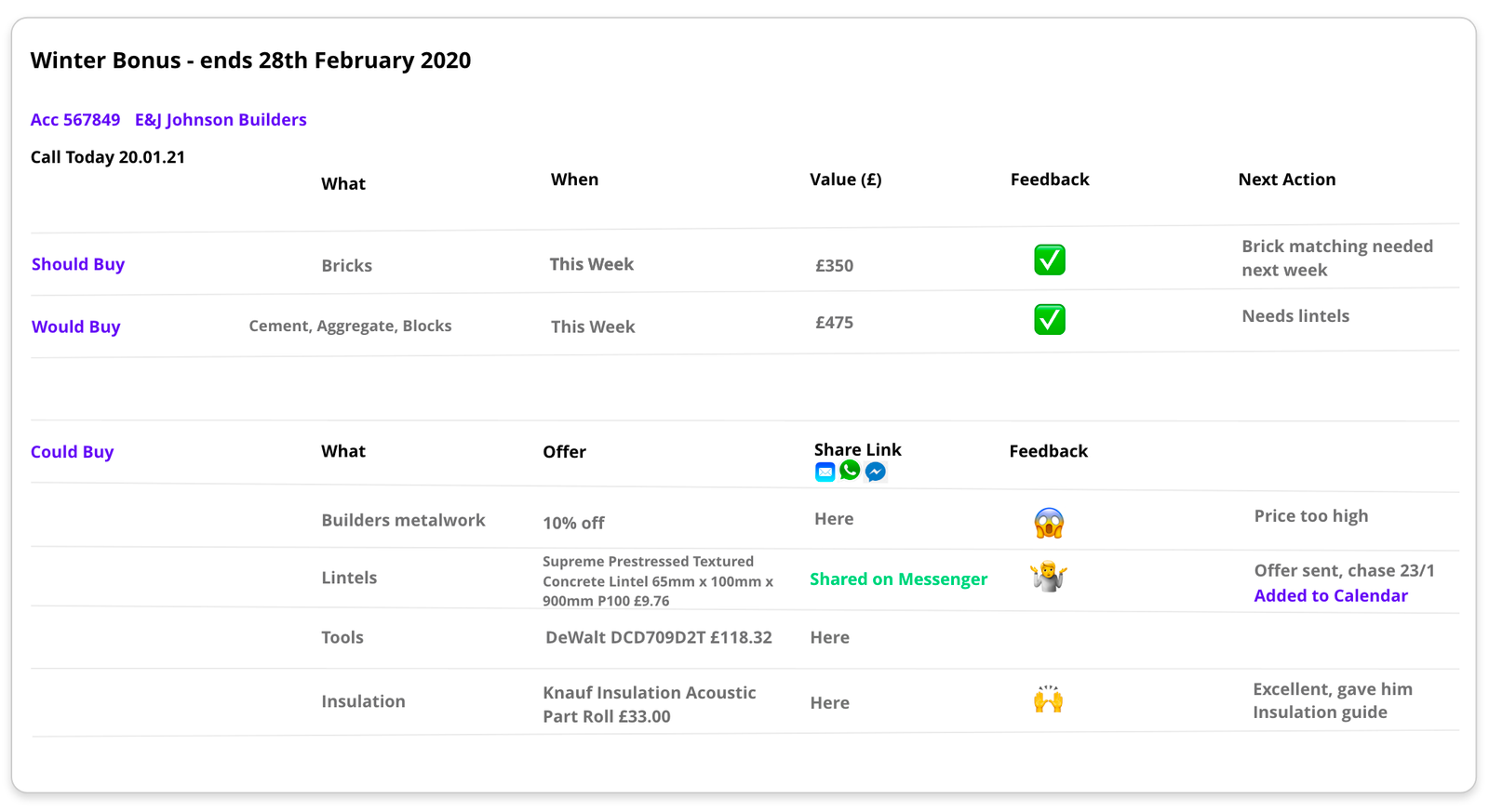

Below is an illustration of what this might look like. This is your Customer Sales Focus slide. The idea is to have this information available to branches, either to action with the customer, or on their proactive call outs to customers. .

Clear and precise activity

The framework of “Should, Would, Could” helps colleagues to understand what supplies the customer should be buying and what time frame.

In this example, we are expecting to see an order this week for a Distribution board with associated products, we are also suggesting that there are opportunities with tools, smart lighting, test equipment and smart controls for heating. We have the ability to share these offers through Whatsapp, Messenger, email, sms or post to ecommerce. This can either be done through an automated campaign or via Branch approval.

The branch has offered their feedback in the right hand side columns. We use easy to know symbols for structured feedback and narrative text for deeper understanding. All of this is part of the feedback to refine the customer offer.

All this sales guidance is 90% accurate and is based on proven AI-based technology.

TP is known for availability, convenience and speed of service

Using smart technology, we can help you keep on top of customer needs. But also help the customers so they don’t have to search all the time.

You can offer more, based on recommendations for the job, not just on Daily/Weekly/Monthly Offers. This is much more relevant for the customer.

Of course, once you have better demand forecasting and customer merchandising these techniques can better help you with your auto-replenishment models and high availability proposition, which in turn, improves ROCE in the longer term.

Your colleagues have less time to be calculating customer opportunities. If you can put this information in their hands, with an action which is scalable across the base, backed up by integrated direct and digital marketing support, you might just be on to something.